(bb) The standard deduction is 15 percent of income with a minimum of 1,550 and a cap of 2,350 for single filers and married filing separately filers. H&R Block ® is a registered trademark of HRB Innovations, Inc. The dependent personal exemption is structured as a tax credit and begins to phase out for taxpayers with income exceeding 200,000 (head of household) or 400,000 (married filing jointly). TurboTax ® is a registered trademark of Intuit, Inc.

*) These amounts may have additional limitations for retirement and pension beneficiaries using the Tier Structure Subtraction

IRS Standard Deduction: Federal Standard Deductions.Other Standard Deductions by State: Compare State Standard Deduction Amounts.Michigan does not have itemized deductions. $40,000 *) for a married filing joint return.Tax Rates on Long-Term Capital Gains and Qualified Dividends TAXABLE INCOME LTCG TAX SINGLE FILERS MARRIED FILING. $20,000 *) for a single or married filing separate return 3.8 tax on the lesser of: (1) Net Investment Income, or (2) MAGI in excess of 200,000 for single filers or head of households, 250,000 for married couples filing jointly, and 125,000 for married couples filing separately.This deduction is referred to as the Michigan Standard Deduction: If you were born after 1946 and have reached the age of 67 (you are considered to have reached the age of 67 the day before your 67th birthday and not after the current Tax Year ) you can deduct the following amounts all your tax year income (including retirement and pension income - via pension schedule Form 4884). The eFile tax app applies these amounts on Michigan tax returns prepared on . County property tax administration fee of 4 percent added to unpaid 2021 taxes and interest at. Michigan taxpayers qualify for a $5,000 exemption per taxpayer on Michigan tax returns. Total dependent credit allowed is 364 Total exemption credits allowed is 457 2021 California Tax Rates, Exemptions, and Credits The rate of inflation in California, for the period from July 1, 2020, through June 30, 2021, was 4 personal. Like many other tax credits, this one is also. OCTOBR 2021 Exemption credits Married/RDP filing joint, and surviving spouse 258. Child and Dependent CareAbout 20 to 35 of allowable expenses up to 3,000 for each child under 13, a disabled spouse or parent, or another dependent care cost can also be used as a tax credit. Michigan Standard and Itemized Deductions The child tax credit starts to phase out once the income reaches 200,000 (400,000 for joint filers). For your personal Effective IRS Tax Rate use the RATEucator Tool.Income Tax Brackets for Other States: Compare State Tax Brackets, Rates.Michigan was taxed at a flat tax rate of 4.25% for all levels of income.

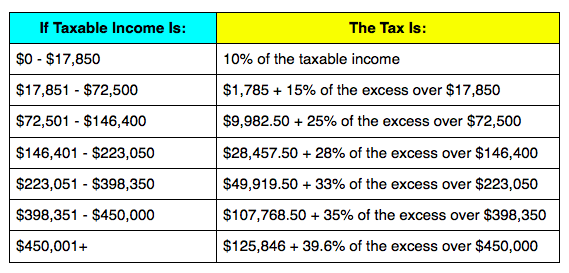

Michigan is taxed at a flat tax rate of 4.25% for all levels of income. Michigan Tax Brackets for Tax Year 2023Ģ023 MI tax rate will be updated as they become available. When you prepare your return on this is all calculated for you based on your income. Here you can find how your Michigan based income is taxed at a flat rate. Income Tax Brackets, Rates, Income Ranges, and Estimated Taxes Due Calculate and Estimate your IRS Income Tax Brackets and Rates with the eFile RATEucator.

0 kommentar(er)

0 kommentar(er)